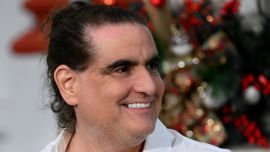

The governor of the Central Bank of the Republic of Argentina, Miguel Ángel Pesce, answered questions on fintech and regulation in Argentina during a recent interview with Jorge Fontevecchia.

The fintech sector complains about Central Bank measures which hurt them. What is your vision of the fintechs?

Not all fintechs are the same. It depends on whether we are referring to those who offer payment services via electronic ATMs or virtual accounts. I believe that it has been very important to make the extension of the accounts system more dynamic, reaching sectors which previously had no possibilities of opening bank accounts, because the banks fell short there in our previous Central Bank term. We insisted on the need for opening free and universal savings accounts. We did not have much success and that space was later efficiently covered by the fintechs. They are a new instrument, not financial entities so we have to be very careful.

Financial entities have a complete reinsurance chain to guarantee the deposits in their accounts so that they can be returned in any circumstance, ranging from deposit insurance to the statutory reserve requirements imposed by the Central Bank, as well as the regulatory and supervisory chain provided by the Central Bank. This is not present in the fintechs so we have to safeguard the people using that transactional system for their financial operations. What we have done is to oblige payment service companies to deposit 100 percent of the money in banks as a kind of statutory reserve requirement.

This is a step in the direction of making more independent the assets of companies lending out the assets deposited in them while on the other hand, the payment service companies profit from those deposits – deposits which were not theirs but came from third parties. In the eyes of the Central Bank those kinds of operations are financial intermediation and the only companies which can provide financial intermediation are those authorised by the Central Bank. These companies are authorised to make transactional payments but not to offer financial intermediation and we have adjusted our regulations accordingly.

In that sense this might cause some resentment in the short term but I believe that it helps to have a solid system, even within the context of payment services, by making sure that we do not have a problem when people lose confidence in the system and abandon it because some of these companies might fail to deliver.

How do you evaluate the launch of the interoperable QR code? Will physical money disappear, as is already starting to happen in some Asian countries, substituted by digital?

I think that it is an inexorable path. Material money will be substituted by digital money, electronic transactions are much more efficient than handling money because material money has very high logistic costs.

Banks and big businesses perceive those costs. At times small companies or individual persons do not perceive the cost of withdrawing cash from the bank and the risks it carries. What has happened with electronic cheques, which are advancing at giant strides over paper cheques, will also happen with payments via electronic mechanisms, I believe. We think that the unification of the QR code or the interoperability of the QR codes has been a very important step in this direction.

It is no use having islands within the system. There must be an integrated system whereby the companies offer services, winning out according to the efficiency of the service offered. But all these systems are interoperable and do not generate oligopolistic structures. Within the market operations coded by variables have been constantly rising but with different service providers, growing strongly since we permitted them to operate via home banking with electronic invoicing and collection.

The operations of invoicing in capital markets have been published and there are companies offering platforms to PyMES (small and medium-sized companies) so they can obtain financing from banks through their invoicing of bigger companies. This has caused electronic mechanisms to advance at an accelerated pace.

I don’t know when the complete replacement of one instrument by another will happen. There is a very long tradition of using material money but it’s going to end up happening.

Comments