The Mercosur trade bloc looks set for decisive year that could dramatically reshape its role, with Uruguay, Brazil and Paraguay attempting to forge a new path for the bloc that would allow countries to sign bilateral deals independently.

Officials from member nations are already preparing for the Mercosur’s next presidential summit in June, but the regional trade bloc is facing an uncertain future, with one analyst describing it this week as in a “highly fragile state.”

The Mercosur – which is also made up of Argentina and Venezuela, with the latter’s membership currently suspended – has come in for stark criticism in recent months, with critics charging that it is one of the least-effective entities in the world, both in terms of trade between its members and with external partners.

In recent years, calls for the bloc’s shake-up have escalated and now, given recent political shifts in the region, experts feel the time for change may be arriving.

“Mercosur is facing a highly fragile state,” said Julieta Zelicovich, an expert and researcher in international relations. “To the weak institutional structure of the bloc we can add new ideological differences between its members. The ideologies of the presidents’ matter and that conditions the direction taken by the bloc.”

Individual trade agreements by the Mercosur members are banned by what’s known as “Decision 32,” which was agreed at a summit in Buenos Aires 20 years ago. Changing the rule would mean transforming the bloc from a customs union to a free-trade zone, which wouldn’t be simple and would require long discussions.

Calls for a shake-up of the rules for bilateral trade deals have also been met with demands to reduce the common external tariff (TEC) of the bloc. Tariffs currently average 14 percent and those levels haven’t been changed in 25 years. Last year Argentina, then led by Mauricio Macri, and Brazil pushed to lower them to five percent in the long term, as a way to improve trade with the rest of the world.

Last year, the Mercosur’s members exported goods worth US$227.2 billion to countries from outside the bloc, a 17 percent drop from 2018. China, the US and the Netherlands were the main destinations. Meanwhile, imports to the bloc totalled US$175.1 billion, a 20 percent decline from the previous year.

“There’s a clear desire from several countries to make the bloc more flexible, which would mean lower tariffs and bilateral trade deals,” Marcelo Elizondo, a trade expert at the DNI consultancy firm told the Times. “It is something that will happen sooner or later and would be difficult to stop it.”

NEW REGIONAL OUTLOOK

The political tide has turned in Latin America of late and recent victories in the presidential elections for Alberto Fernández in Argentina and for Luis Lacalle Pou in Uruguay have again changed the region’s outlook. Inevitably these shifts have implications for the Mercosur.

Lacalle Pou, who will take office in March, defeated his leftwing Frente Amplio rival Daniel Martínez in a second-round runoff in November. The conservative politician recently shared a phone call with US State Secretary Mike Pompeo , during which they discussed the possibility of a free trade agreement, “either with Mercosur or bilaterally with Uruguay,” according to a press release issued by the Partido Nacional leader.

“Lacalle Pou is trying to force the Mercosur bloc to change its rules. If this doesn’t happen because of Uruguay, it will be because of Brazil,” said Miguel Ponce, the director of the Centro de Estudios para el Comercio Exterior Siglo XXI, in an interview with the Times. “I don’t see the bloc following the same status quo.”

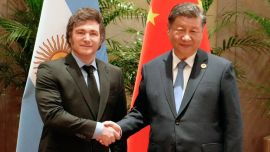

A stand-out feat u re of Uruguay’s foreign policy over the past few years has been its desire for a trade deal between Mercosur and China. But that idea was dismissed by the other members of the bloc.

Now, Uruguay’s interests seem to be on the same page as Brazil and Paraguay, the current pro-tempore president of the bloc, which could make changing the rules of the bloc a key discussion point in June.

“There will be growing pressure to change the rules of the bloc, but it would be difficult for this to happen. Allowing bilateral deals would be a big leap for the trade bloc and it won’t be quick,” Zelicovich said. “It’s a power play to move the bloc on a certain direction.”

As with Lacalle Pou, Brazilian President Jair Bolsonaro has repeatedly expressed his desire for bilateral deals outside the Mercosur. During a BRICS summit in November, Brazilian Economy Minister Paulo Guedes said negotiations with China for a free-trade deal were already underway.

At the same time, US President Donald Trump said last year that his country “will pursue a free trade agreement with Brazil,” describing the country as a “big trading partner” that currently hits the US “with a lot of tariffs.” Both countries exchange more than US$100 billion in goods and services every year.

“I don’t see a consensus between Paraguay, Brazil and Uruguay yet but it’s clear they are on the same page,” Elizondo said. “In Lacalle Pou, Bolsonaro will have a stronger ally than in [ex-Uruguay president] Tabaré Vázquez. Paraguay, as an ally of Brazil, will follow the same direction.”

That could leave Argentina isolated and out in the cold. President Fernández’s approach to the Mercosur has not yet been defined but look closely enough and there are some signs. The fact that the government is asking importers to anticipate their importing needs for the year and the new taxes for purchases abroad could be a hint of a more protectionist economy, experts agree.

If the bloc ends up changing its rules, one possibility could be for Argentina to delay opening up its economy to bilateral deals, while the rest take the opposite path.

FINALISING THE EU AGREEMENT

The main event this year, however, could be the Mercosur’s historic free-trade agreement with the European Union, agreed last year after more than 20 years of negotiations. Member nations will have to take major steps if they are to make the deal a reality.

As agreed previously, during the first 10 years of trading, the agreement would see the gradual elimination of 91 percent of the tariffs levied by Mercosur on European imports, an amount that represents about US$4 billion per year, according to EU data.

Meanwhile, in response, the EU would eliminate 92 percent of the tariffs applied to goods shipped from South American countries over the same 10-year period. In the agricultural sector, 81.7 percent of products would not pay taxes, while the remaining 17.7 percent would have only specific quotas

But for that to happen, there’s still a long way to go. Each country has to start an internal discussion over the agreement. The EU Parliament will have to approve it too, as well as the parliaments of the 28 EU member nations. The same applies to the Mercosur, as the agreement will have to go through the four legislatures of its members.

The backdrop to the discussions indicates a tough read ahead. Fernández said during the presidential campaign that the deal “punishes” Argentines and vowed to place it under review. Meanwhile, agriculture lobby groups from Germany and Ireland also anticipate growing pressure against the accord.

The EU and Mercosur currently exchange almost US$100 billion in goods annually, with a balance very slightly in favour of the Europeans. In Argentina, trade with the EU accounts for 15 percent of all trade, exporting biodiesel, beef and soy and importing manufactured and value-added goods.

Comments